Foreign Exchange Dealers (ForEx Dealers) make foreign exchange transactions after analysing global market conditions and identifying profit-making opportunities.

Foreign Exchange Dealer Job Description

- Analyse key industry challenges and potential scenarios that affect the foreign exchange markets.

- Assess operational risks due to financial market activities, and determine if mitigating actions are needed.

- Monitor currency fluctuation and evaluate foreign exchange markets to identify trading opportunities and formulate trading strategies.

- Price and value foreign exchange products and foreign exchange derivatives to provide price quotes to clients.

Note

Foreign Exchange Dealers know exchange rates at the back of their hands. Bring them to a McDonald's in Singapore to get a Big Mac, and they can probably tell you how much it would be in Malaysia!

What you should know about Foreign Exchange Dealer jobs in Singapore

Nature of Work

As ForEx Dealers, your primary role involves trading currencies in the foreign exchange market and making analytical decisions.Key Advice

Stay updated on global Economic trends and Geopolitical events to make informed trading decisions.-

Entry RequirementsEntry Requirements

- A bachelor's degree or minimally a diploma in Banking and Financial Investment, Banking, Insurance and Financial Services N.E.C. (Including Computational Finance) or related fields is needed.

- Typically, it is not an entry-level job - prior work experience in market analysis is needed.

-

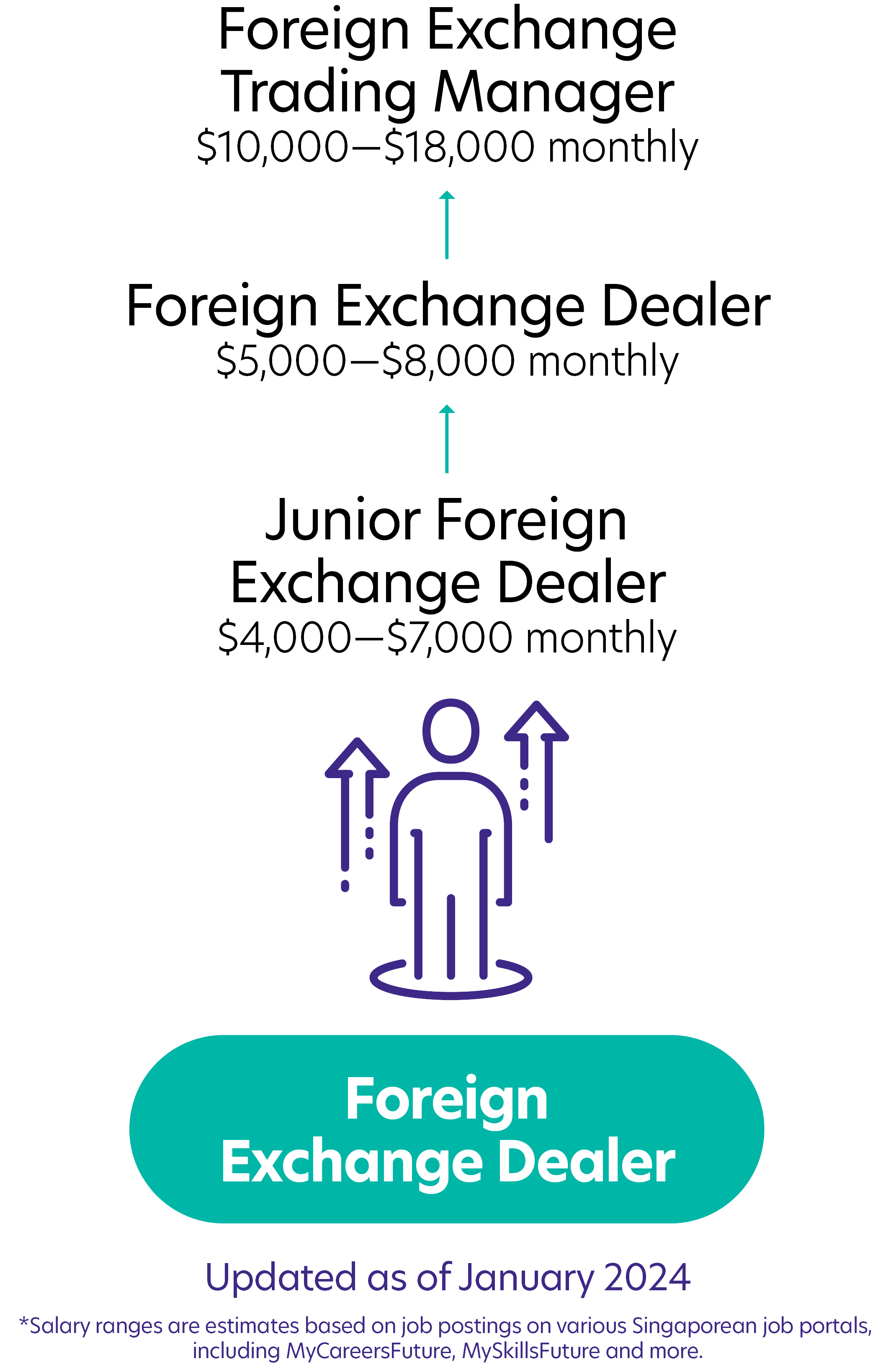

Possible PathwayPossible Pathway

Skills you need to pursue a Foreign Exchange Dealer career in Singapore

Hard Skills

Hard Skills

Able to respond quickly to foreign exchange market conditions

Swift reactions to market shifts secure trading profits.Fundamental Understanding of the ForEx market

Grasping ForEx, economics, trends, and geopolitics shape trading tactics.Monitoring daily loss and profit positions in the trading book

Analysis and strategy tweaks to maximise trading outcomes.Analytical Skills

Critical analysis of market data and economic indicators is essential for forecasting trends.Organisational Skills

Efficiently manage multiple tasks and stay organised in the complex world of ForEx trading.Global Perspective

Understanding global markets enhances your ability to predict market trends and trading opportunities.Related Job Roles

Explore Other Programmes

Browse AllYou have bookmarked your first item!

Find it in My Discoveries with insights on your interests!