Quantitative Traders are Specialised Traders who apply quantitative methods to assess Financial Markets or products. They use Mathematical models to identify trading opportunities and buy and sell stocks and bonds.

Quantitative Trader Job Description

- Extract and discover patterns in price data to pull out underlying trends and anomalies. This involves sifting through vast datasets to identify potential indicators that can predict market movements.

- Identify profitable trading opportunities by applying Mathematical models and Statistical analysis. This requires a keen analytical mind capable of spotting opportunities that others might overlook.

- Design and implement High-Frequency Trading (HFT) algorithms focused on crypto markets.

- Create tools for data analysis of patterns, enabling a deeper understanding of market dynamics.

- Develop and fine-tune exchange simulators to test trading strategies under various market scenarios.

Note

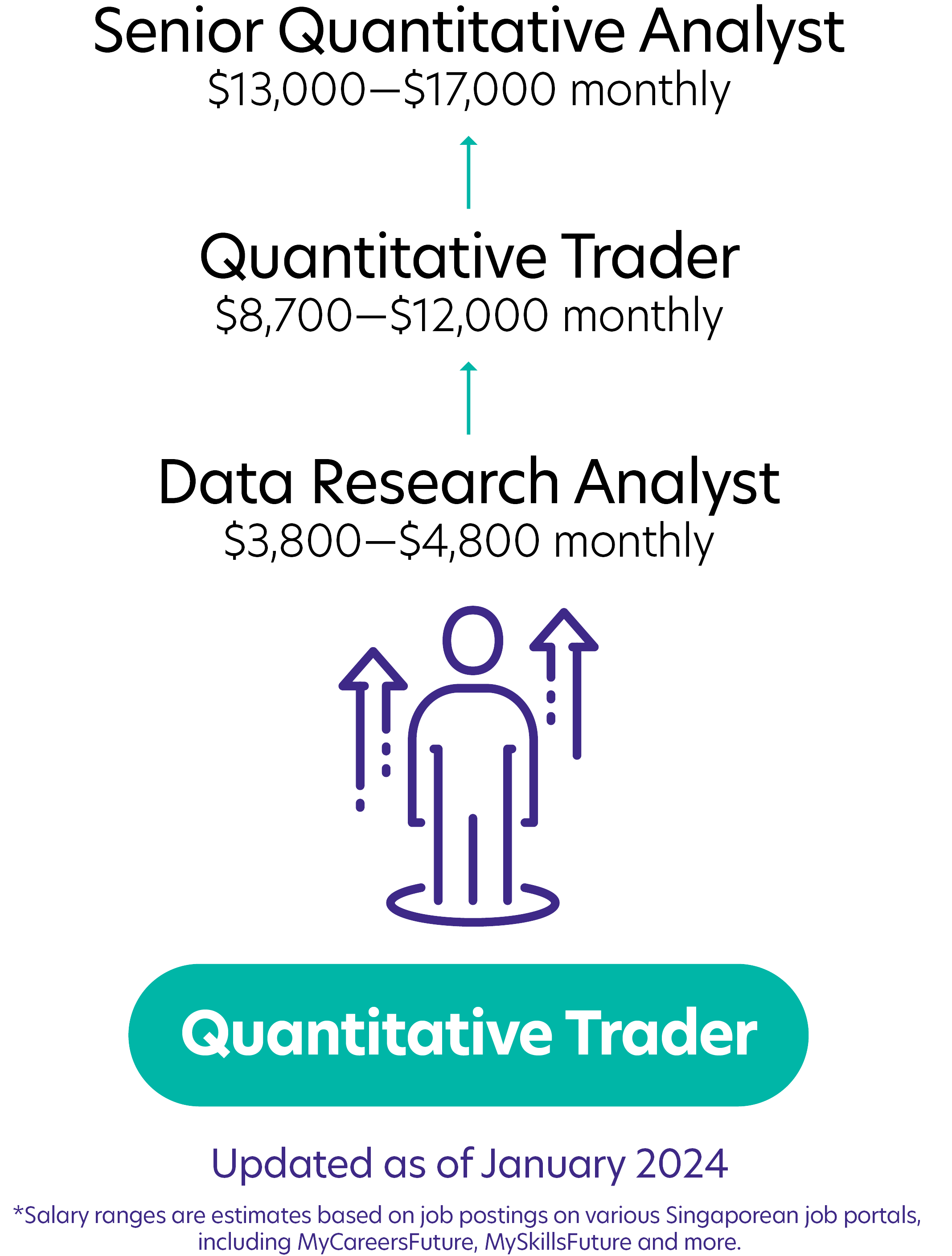

Starting out as Data Research Analysts is your typical career path for Quantitative Traders. To give you a head start, consider taking a master's degree in Financial Engineering to further hone your hard skills.

What you should know about Quantitative Trader jobs in Singapore

Nature of Work

You will be constantly exposed to them when you analyse data, test results, and implement trade strategies.Key advice

It is important to have an in-depth knowledge of Mathematical terms like skewness, conditional probability, kurtosis, and VaR (Value at Risk).-

Entry RequirementsEntry Requirements

- Minimally, you will need a degree in any hard Science field such as Computer Science, Physics, Mathematics, Statistics, or Data Science.

- Proficiency in programming languages such as Python, C++, or Java is essential.

- Strong quantitative and analytical skills to develop and implement complex trading algorithms.

- Previous experience in a Trading environment, especially with algorithmic or High-Frequency Trading, is highly beneficial.

- Knowledge of Financial Markets and instruments is crucial.

-

Possible PathwayPossible Pathway

Skills you need to pursue a Quantitative Trader career in Singapore

Hard Skills

Hard Skills

Strong Mathematical Skills

Essential for analysing financial data and developing complex trading algorithms.Programming Proficiency

Competent in C++, Java, Python and Perl for creating and implementing trading models and algorithms.Financial Markets Knowledge

Deep understanding of market dynamics, trading strategies, and financial instruments.Risk-Taking

Ability to make calculated decisions under uncertainty in financial markets.Innovative Problem-Solving

Skill in finding creative solutions to complex trading challenges.High-Stress Tolerance

Maintaining composure and decision-making efficiency in fast-paced trading environments is crucial.

“A good Trader makes decisions and takes calculated risks based on the knowledge that they have.”

Bryan, Theme International Trading, Quantitative Trader

Related Job Roles

Explore Other Programmes

Browse AllYou have bookmarked your first item!

Find it in My Discoveries with insights on your interests!