Underwriters evaluate an entity's financial status and make important decisions such as taking up loans and signing contracts.

Underwriter Job Description

- Develop pricing models, structures and product features.

- Analyse market data and competitor trends to ensure our products remain competitive and financially sound.

- Establish and maintain good relationships with customers as well as with brokers and other distribution partners.

- Monitor underwriting market trends, competitor pricing and their developments.

- Perform underwriting evaluation of the client's life and health care.

- Review and improve current underwriting processes, policy coverage and terms.

Note

Clients submit financial records to Loan Officers or Underwriters before borrowing. Underwriters often complete assessments more quickly, serving as time savers for clients!

What you should know about Underwriter jobs in Singapore

Nature of Work

Loan Officers represent moneylenders, while Underwriters work independently, often completing assessments faster and saving time for clients!Key Advice

You have to keep up with changing regulations and policies which are relevant to the industry. These regulations can affect company evaluations.-

Entry RequirementsEntry Requirements

- A diploma or bachelor’s degree is needed. There is a preference for Business Administration, Finance and Accounting degrees in this role. Other accepted degrees are Statistics, Economics or Engineering.

- Seek out internships or entry-level positions that allow you to gain experience in the industry.

-

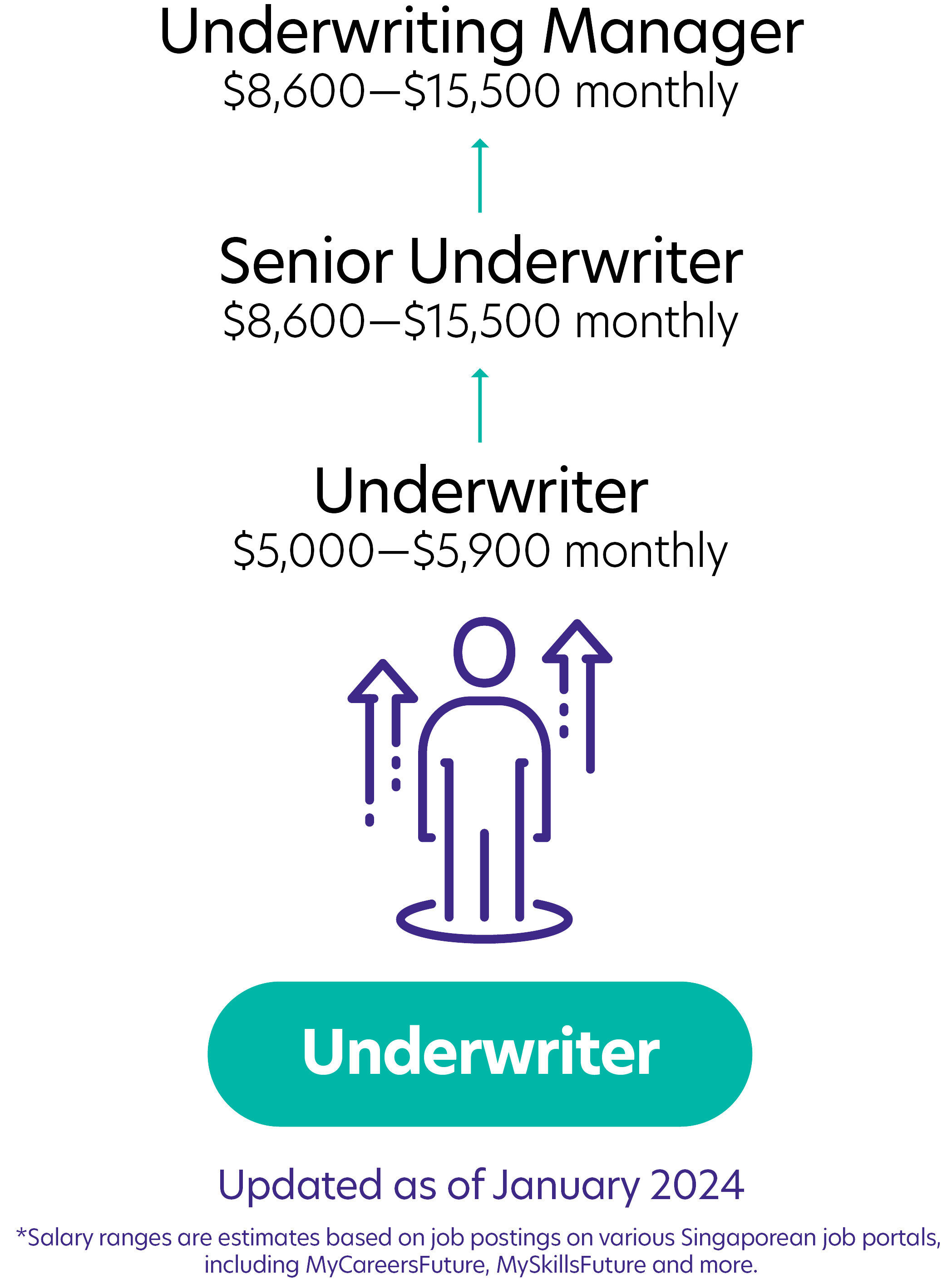

Possible PathwayPossible Pathway

Skills you need to pursue an Underwriter career in Singapore

Hard Skills

Hard Skills

Statistical Skills

Proficiency in understanding and interpreting statistical data to assess risks accurately.Familiarity with financial modelling software

Competence in using software tools for financial analysis and modelling.Data Analytics

Ability to analyse and interpret complex data to make informed decisions.Communication

Strong verbal and written communication skills for clear and effective interactions with clients and colleagues.Innovative Problem-Solving

Creativity in addressing challenges and developing unique solutions.Sense-Making

Ability to make sense of complex information and trends to inform decision-making.Related Job Roles

Explore Other Programmes

Browse AllYou have bookmarked your first item!

Find it in My Discoveries with insights on your interests!