Valuers are professionals who determine the market value of land or buildings. They use their knowledge to then advise their clients on how to get the most profit from selling or renting their property.

Valuer Job Description

- Take measurements of the property's interior and exterior.

- Inspect both the exterior and interior of buildings for damage or structural issues.

- Propose ways of improving the property to increase its value.

- Compare the value of the property with surrounding properties' values.

- Write a report of all the findings, including photographs of the property being evaluated.

- Analyse local market trends and data to inform valuation estimates and provide clients with current market insights.

- Attend auctions and visit properties for sale to keep abreast of the Real Estate market and valuation standards.

- Engage with Legal and municipal documents to ensure all property details are accurate and compliant with local regulations.

Note

Specialising in one property type sharpens Valuers' insights, enabling more accurate, valuable client advice.

What you should know about Valuer jobs in Singapore

Nature of Work

You must assess property value using the most recent data, considering market trends and property specifics for the most accurate evaluations.Key Advice

You should master various appraisal methods, such as Sales Comparison Approach and Cost Approach Appraisal, for accurate property evaluations.-

Entry RequirementsEntry Requirements

- Minimally a bachelor's degree in Real Estate or similar.

- You will need to obtain a licence, which requires at least 2 years of experience working as Real Estate Agents. You must be licensed by the Singapore Institute of Surveyors and Valuers (SISV) or the Inland Revenue Authority of Singapore (IRAS). The link between IRAS and Valuers may not be obvious but IRAS deals with property tax. Hence, it needs Valuers to determine the tax amount, which is why it issues licences to Property Valuers.

- Knowledge of local property Laws, regulations, and guidelines, including those related to land use, zoning, and environmental restrictions, to ensure compliance in valuations.

-

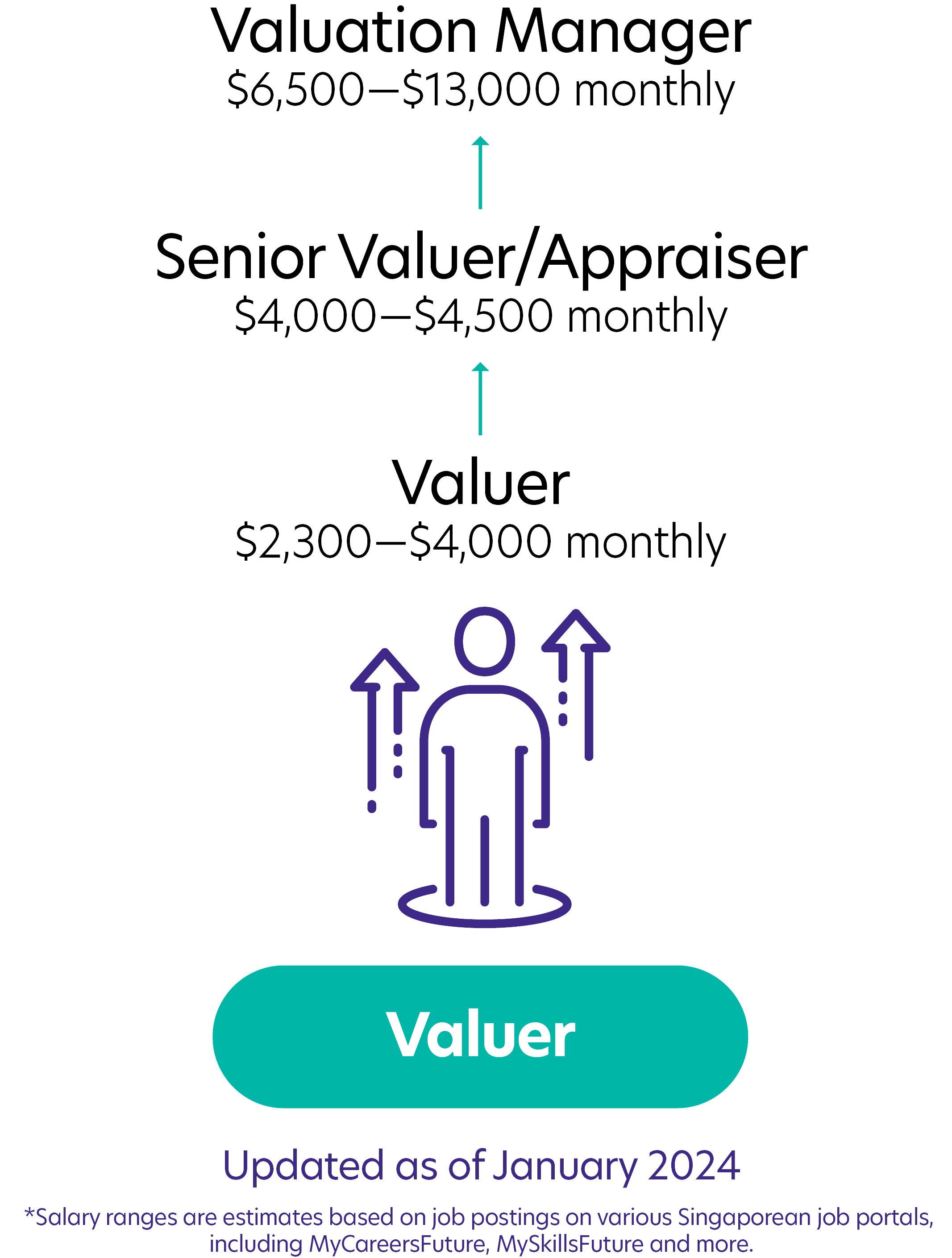

Possible PathwayPossible Pathway

Skills you need to pursue a Valuer career in Singapore

Hard Skills

Hard Skills

Knowledgeable in Local Property Market

Understanding of market trends, property laws, and economic factors affecting values.Appraisal Methods

Mastery of valuation techniques, including comparative, income, and cost approaches for accurate assessments.Knowledge of Local Real Estate Industry

Familiarity with Real Estate regulations, development patterns, and investment climate.Attention to Detail

Precision in analysing property features, legal documents, and market data for exact valuations.Problem-Solving

Ability to navigate complex valuation challenges, adapting methods to unique property characteristics.Communication

Efficient in conveying valuation findings, negotiating with stakeholders, and writing comprehensive reports.Related Job Roles

Explore Other Programmes

Browse AllYou have bookmarked your first item!

Find it in My Discoveries with insights on your interests!