Corporate Financial Analyst jobs in Singapore involve analysing business performance and advising on project costs, investments and financial strategies.

Corporate Financial Analyst Job Description

- Network with existing clients to know their needs and desires.

- Monitor financial operations and ensure compliance with legislation and regulatory requirements.

- Work alongside the equity capital market syndication desk* to originate deals that are profitable and attractive on the market.

- Assist the legal teams in preparing the companies' prospectus and transaction documents.

- Finalise transactions through registration and prepare for the announcement of the deal.

(*A syndicate desk is a group of people responsible for researching, marketing and pricing bonds, loans or stocks of companies. Essentially, it helps the company price its new deals so that they are attractive on the market!)

Note

Corporate Financial Analysts are good decision-makers. With so many variables that affect the market, they are quick on their feet to analyse and make rational decisions. They are likely the first few to decide what they want for lunch - no bickering!

What you should know about Corporate Financial Analyst Jobs in Singapore

Nature of Work

As Financial Analysts, you’ll analyse data, market trends, and economic conditions to provide insights for business decisions, aiding in financial planning and strategic initiatives.Key Advice

Coding languages such as Python may also be a bonus to know, as it may come in useful when cleaning data.-

Entry RequirementsEntry Requirements

- Minimally a diploma in Accountancy, Banking and Financial Investment, Banking, Insurance and Financial Services N.E.C. (Including Computational Finance) is needed.

- Familiarise yourself with software like Spotfire, Tableau and Power BI. They are software platforms that help you gather, analyse, and visualise data.

-

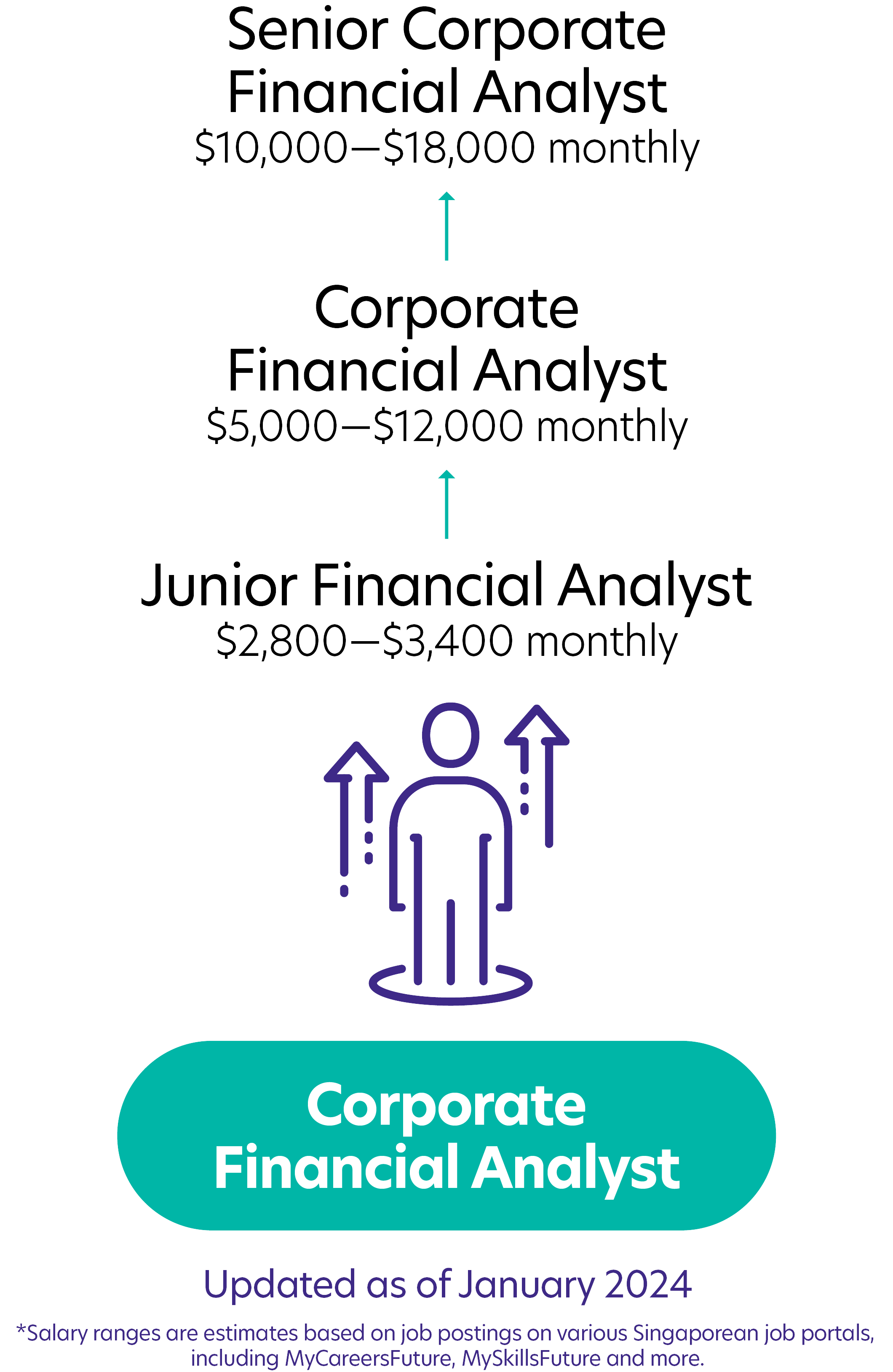

Possible PathwayPossible Pathway

Skills you need to pursue a Corporate Financial Analyst Career in Singapore

Hard Skills

Hard Skills

Project Management

Requires robust project management skills with business goals and ensuring timely delivery.Data Analysis

Financial data analysis is required to interpret trends and data tools to use.Familiarity with Business and Financial Risks

Understand and mitigate business risks for strategic planning.Innovative Problem-Solving

Creativity in tackling financial challenges and innovating solutions.Adaptability

Adapt to changing financial environments, regulations and market conditions.Communication

Conveying financial insights, collaborating with the Finance team, and engaging stakeholders proficiently.Related Job Roles

Explore Other Programmes

Browse AllYou have bookmarked your first item!

Find it in My Discoveries with insights on your interests!