Market Risk Analysts inform companies and investors about analyses on market trends. They help to make better investment and risk management decisions.

Market Risk Analyst Job Description

- Gather data required for drafting responses to queries from other market professionals.

- Monitor market risk and liquidity risk limits for potential threats or irregular activities.

- Analyse identified market events and developments which may impact an organisation.

- Produce reports and/or presentations that outline risk-related market and financial forecast findings.

- Assist in the risk, compliance and legal specialisation of investment banking.

- Monitor and analyse market risks, monitor credit and liquidity risks for trading.

Note

Market Risk Analysts have a diverse workload. They can hustle more on some days, and have more down-time on others! They also have many opportunities to work in different industries!

What you should know about Market Risk Analyst jobs in Singapore

Nature of Work

You must assess financial market risks using quantitative methods, advising on strategies to optimise performance.Key Advice

You specialise in risk, compliance and legal systems. Be prepared to read up a bit on the law and apply relevant rules to the analysis!-

Entry RequirementsEntry Requirements

- A bachelor's degree in Finance, Business, Accounting, and Statistics is preferred.

- Some software that you may be required to know will be Microsoft Excel and PowerPoint.

-

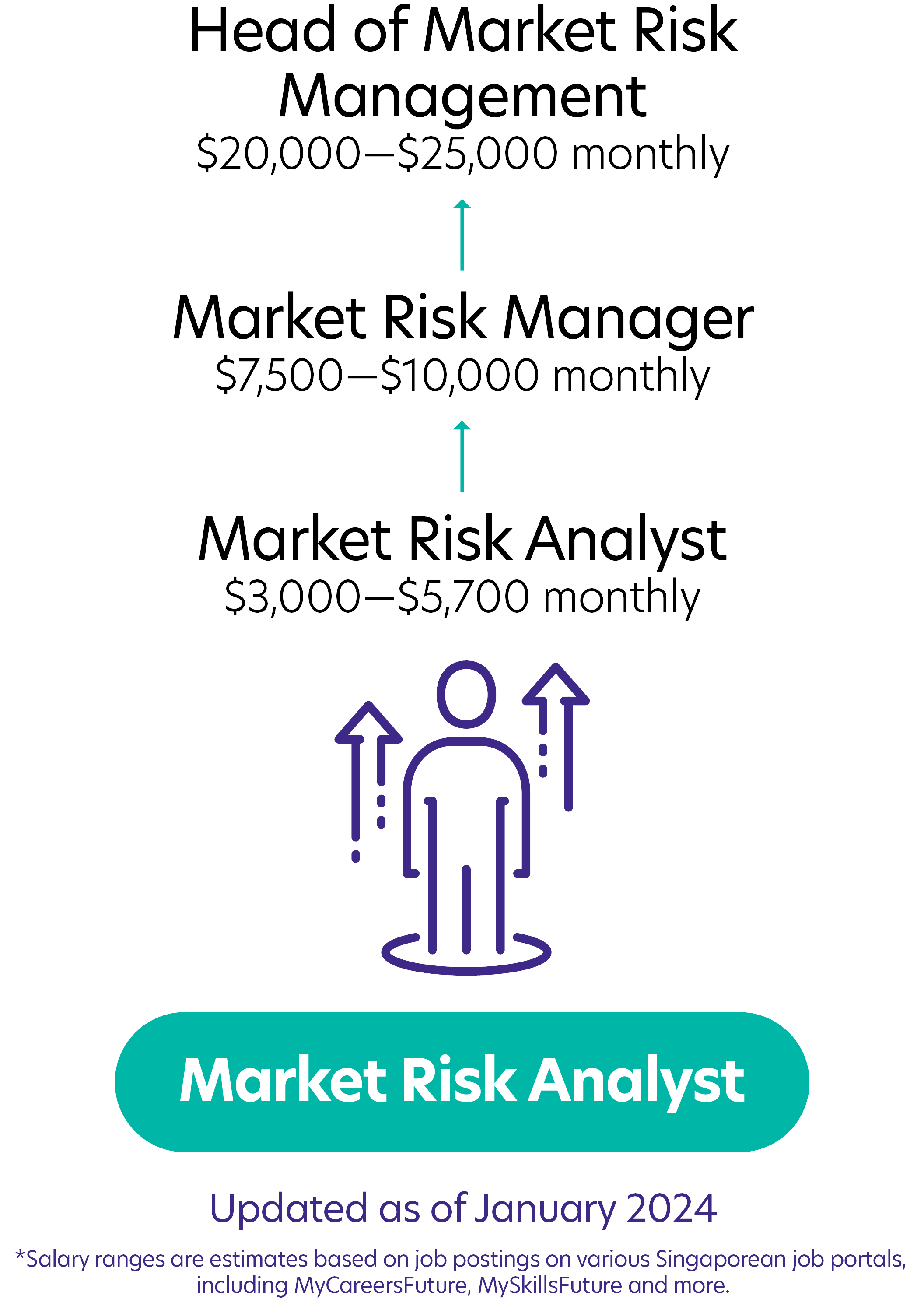

Possible PathwayPossible Pathway

Skills you need to pursue a Market Risk Analyst career in Singapore

Hard Skills

Hard Skills

Data Mining and Modelling

Ability to analyse data to assess market risks and financial scenarios.Scenario Planning and Analysis

Perform scenario analysis and stress testing on portfolios for risk management.Data Analytics

Proficient in data analytics for market trends, risk identification, and financial decision-making.Digital Fluency

Must be adept with digital tech and platforms, using advanced software for risk analysis and management.Problem-Solving

Problem-solving skills are key for market risk challenges and risk mitigation.Methodological Thinking

Methodical market data analysis for accurate risk assessment and strategy.Related Job Roles

Explore Other Programmes

Browse AllYou have bookmarked your first item!

Find it in My Discoveries with insights on your interests!