Credit Analysts perform a supporting role in underwriting, measuring and analysing corporate credit risks. They assess possibilities of loss from a borrower's failure to repay a loan or meet contractual obligations.

Credit Analyst Job Description

- Identify and analyse industry trends, economic conditions, and regulatory changes to credit risk factors and possible risk-mitigating actions.

- Identify variables affecting the quality and value of the corporate loan portfolio.

- Provide credit risk assessment for corporate clients and ensure that loans are made to creditworthy borrowers who minimise risk to the lending institution.

- Monitor, manage, and report Macroeconomic events, including emerging risks (such as the global economic slowdown caused by COVID-19).

Note

Credit Analysts help identify potential credit risks for companies. They aid companies in minimising their loss, which is one of the most important objectives of any business!

What you should know about Credit Analyst jobs in Singapore

Nature of Work

You will create financial models, evaluate investments, and advise to aid business decisions and strategy, guiding firms to profitability.Key Advice

As a Credit Analyst, you make crucial decisions on purchases and interest rates, which can be demanding and shouldn't be taken lightly.-

Entry RequirementsEntry Requirements

- A bachelor's degree in Finance, Accounting, Economics, Business, or a related field is needed.

- You should be familiar with basic Accounting, Finance and Financial Statement Analysis. Theories and applications in Statistics and Economics industry assessment are a bonus to know!

-

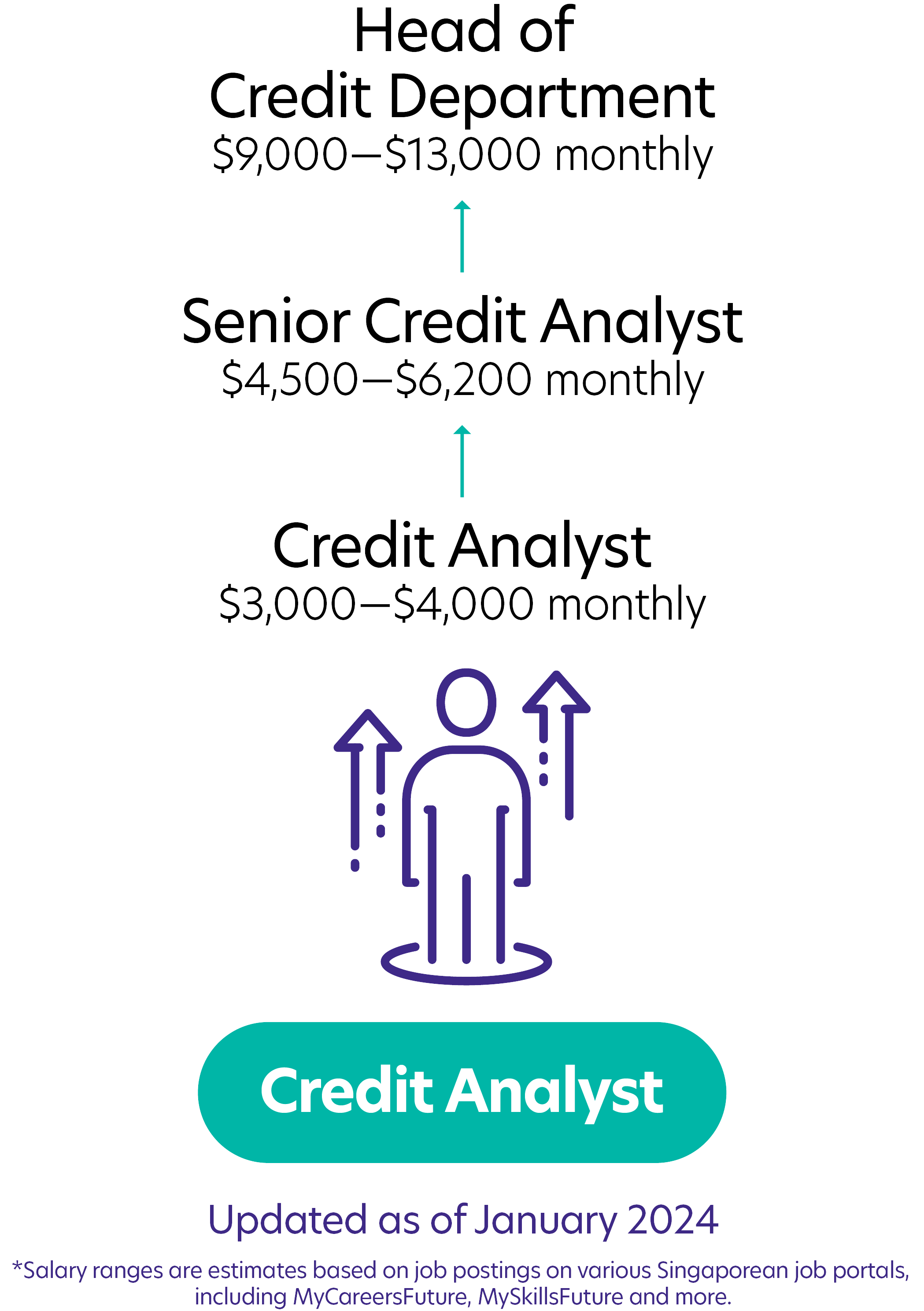

Possible PathwayPossible Pathway

Skills you need to pursue a Credit Analyst career in Singapore

Hard Skills

Hard Skills

Data Analytics

Analyse financial data and trends to assess creditworthiness and risk levels.Advisory Skills

Provide informed, data-driven advice to clients or management on credit decisions and strategies.Proficiency in Financial Software

Proficient in software for financial modelling, risk assessment and credit analysis.Attention to Detail

Carefully scrutinise financial documents and data to ensure accuracy and detect potential risks.Communication

Clearly convey credit-card-related information and recommendations to colleagues, clients and stakeholders.Innovative Problem-Solving

Creatively address complex credit card issues and develop effective solutions for risk management.Related Job Roles

Explore Other Programmes

Browse AllYou have bookmarked your first item!

Find it in My Discoveries with insights on your interests!