Financial Accountants record and interpret companies' financial records. These records communicate financial information to external investors, the internal management team, and tax authorities.

Financial Accountant Job Description

- Meticulously check the accuracy of financial documents and whether they follow laws and regulations and safeguard the organisation from financial discrepancies and legal issues.

- Prepare and maintain financial reports to effectively communicate the financial health of the organisation to management, investors, and other stakeholders.

- Prepare tax returns and ensure taxes are paid on time to minimise tax liability and maximise financial benefits for the organisation.

- Evaluate financial operations to identify issues and strategise solutions.

- Conduct forecasting and risk analysis assessments to anticipate challenges, to help management develop strategies to mitigate risks and capitalise on opportunities.

Note

It is undeniable that automation will replace some of the jobs in the industry. Yet, accountants will always be in demand. Skills such as high-level analysis, strategic thinking, and eliminating compliance issues are always needed!

What you should know about Financial Accountant jobs in Singapore

Nature of Work

To become a certified Accountant, you must pass ISCA and/or ACCA exams, possibly while in school. Balancing your workload is crucial!Key Advice

You don't have to excel at Mathematics, but learning Excel and SAP can aid in business decision-making and financial management.-

Entry RequirementsEntry Requirements

- A bachelor's degree in Finance or Accounting is required. Upon graduation, you would have to sit for an accounting certification exam from The Institute of Singapore Chartered Accounts (ISCA). The ISCA is a Singapore-based National Accountancy body.

- Alternatively, you may choose to take the professional qualification Association of Chartered Certified Accountants (ACCA) after A levels. This does not require a prior diploma or degree and is exams-based.

*Note: ACCA is the global body for professional accountants.

-

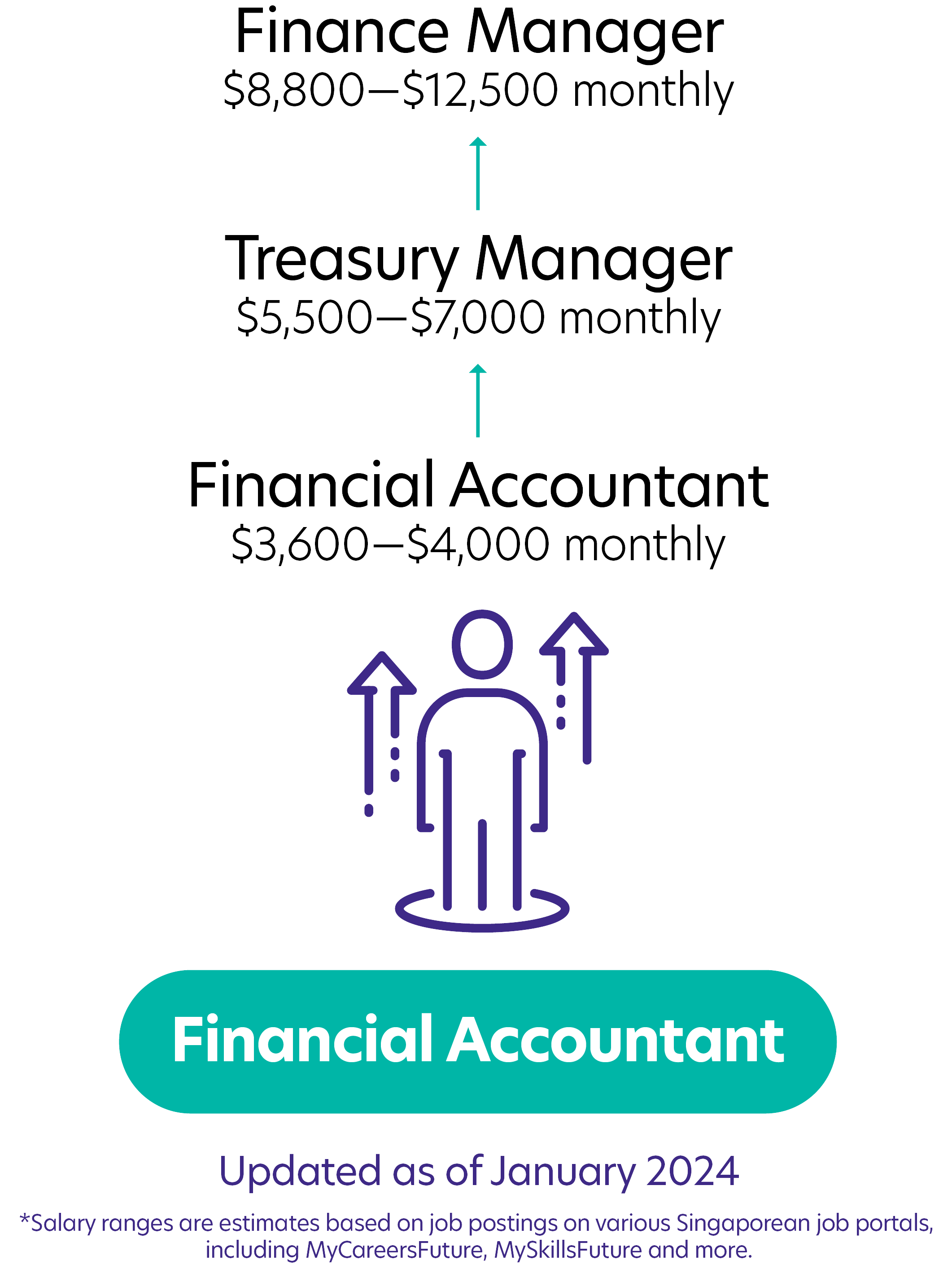

Possible PathwayPossible Pathway

Skills you need to pursue a Financial Accountant career in Singapore

Hard Skills

Hard Skills

Data Analytics

Ability to analyse financial data using statistical tools, for financial reporting and strategic planning.Proficiency in Accounting Software

Expertise in using accounting tools for accurate financial record-keeping and reporting.Project Management

Skills in overseeing financial projects, including budgeting, scheduling, and resource management.Attention to Detail

Essential for ensuring accuracy and compliance in financial documentation and reporting.Communication

Ability to convey financial information to both financial and non-financial stakeholders clearly.Problem-Solving

Critical for addressing financial discrepancies and strategising solutions in dynamic business environments.Related Job Roles

Explore Other Programmes

Browse AllYou have bookmarked your first item!

Find it in My Discoveries with insights on your interests!