Investment (Research) Analysts study industry and market trends to identify new investment opportunities.

Investment (Research) Analyst Job Description

- Analyse and evaluate investment opportunities across all industries by spotting promising sectors and undervalued companies that are instrumental in generating superior returns for investment firms.

- Monitor financial news using specialist media sources which involves analysing financial statements, competitive landscapes, management teams, and future growth prospects.

- Perform in-depth research on target industries and companies and present recommendations to senior management.

- Assist investment banking managers by preparing pitch books for potential clients, conducting due diligence on companies, or valuing assets for investment deals.

Note

Investment (Research) Analysts have extensive knowledge of several different industries. This makes them an important source of information. Thus, clients and companies turn to them for advice.

What you should know about Investment (Research) Analyst jobs in Singapore

Nature of Work

Create data-driven presentations with graphs and charts to illustrate trends, then provide recommendations to clients based on your analysis.Key Advice

Prepare for long hours, including 12-hour days and weekend work, influenced by local and company culture. Manage your time effectively!-

Entry RequirementsEntry Requirements

- A bachelor's degree or equivalent in Banking and Financial Investment is required.

- Having higher degrees or MBAs in Mathematics or financial disciplines is valued and will help with your career progression.

- Seek internships or entry-level positions in related industries as having practical experience in the field is important.

-

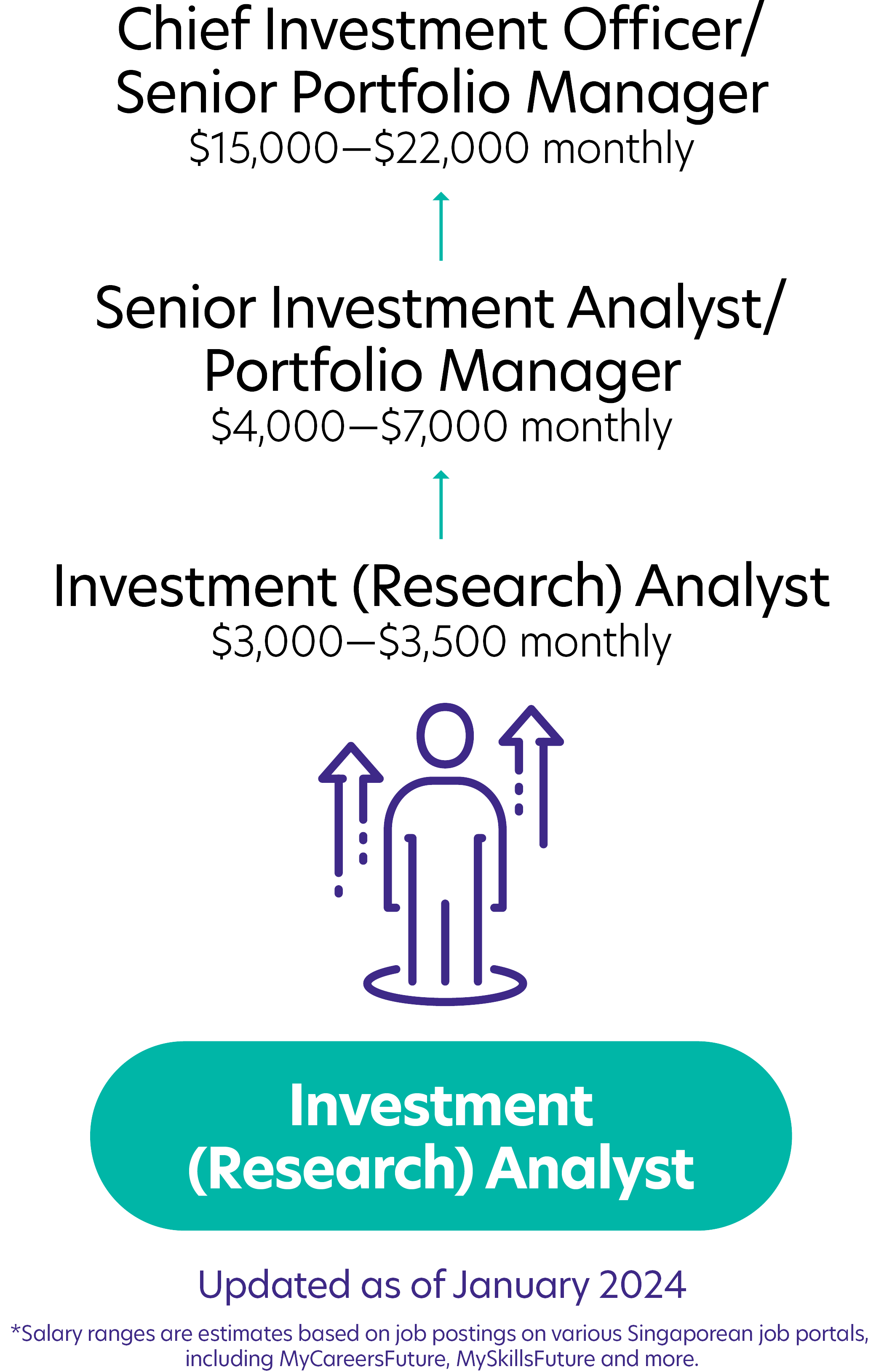

Possible PathwayPossible Pathway

Skills you need to pursue an Investment (Research) Analyst career in Singapore

Hard Skills

Hard Skills

Data Analysis and Representation

Analyse financial data, presenting them as graphs and reports for informed decisions.Research and Summary skills

Conduct thorough market research and summarising findings succinctly.Advisory Skills

Provide sound investment advice through detailed analysis and an understanding of client needs.Attention to Detail

Meticulousness in reviewing financial data and market trends ensures accuracy and reliability.Analytical Skills

Critical thinking and interpreting complex data are vital for informed decisions.Innovative Problem-Solving

Innovative solutions for financial challenges are key to navigating dynamic markets.Related Job Roles

Explore Other Programmes

Browse AllYou have bookmarked your first item!

Find it in My Discoveries with insights on your interests!