Marine Insurance Underwriters evaluate their clients’ risks and process insurance coverage applications accordingly.

- Underwrite Marine insurance.

- Provide recommendations for Claim Handlers.

- Liaise with solicitors and third parties on the best course of action.

- Assess and ensure that risks and prices meet the client's expectations.

- Collaborate with Marine Insurance Claims Handlers and ensure quick turnaround time for clients.

Note

The role will involve working with different stakeholders, such as the customer service teams, clients, brokers, and agents. It is important to be a strong communicator to represent the client’s best interests.

Nature of Work

As Underwriters, you will work closely with customer service teams and build strong relationships with them to facilitate the coordination of information on processes.Key Advice

Marine Insurance Underwriters should be decisive. You’ll work within tight deadlines and often make tough underwriting decisions based on the client’s corporate guidelines.-

Entry RequirementsEntry Requirements

-

A degree in any one of the following disciplines: Maritime Studies, Accounting, Business, Economics, and Law.

-

Possess strong numerical abilities and meticulousness.

-

Able to work under pressure and tight deadlines.

-

-

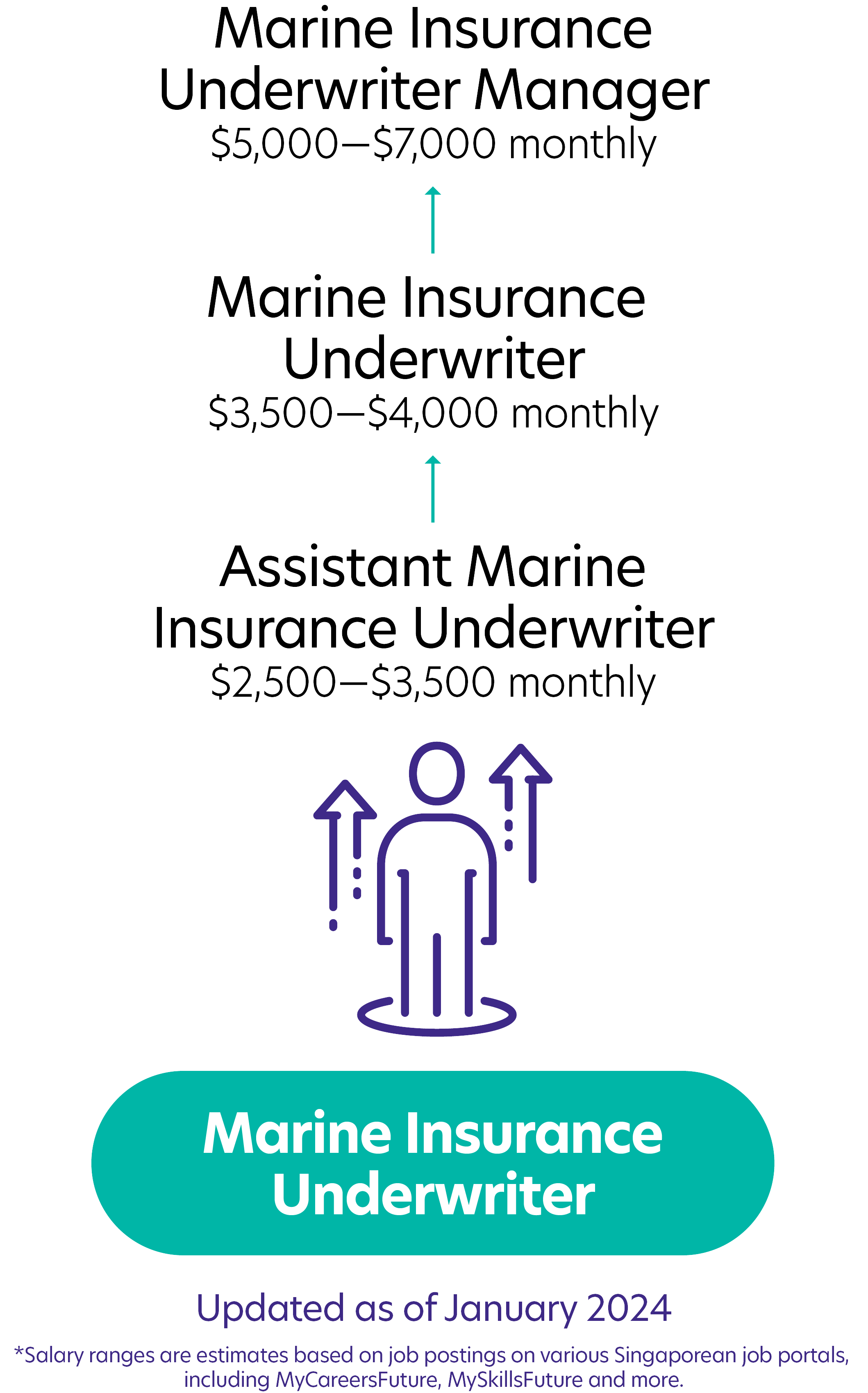

Possible PathwayPossible Pathway

Commercial Acumen

Understanding the commercial aspects of marine insurance, crucial risk assessment and policy development.Numerical Skills

Proficiency in numerical analysis is essential for accurately assessing risk and determining policy premiums.Familiarity with Various Risk Assessment Software

This is important for evaluating insurance applications and managing policies.Underwriting Skills

Expertise in underwriting is key to evaluating risk and making informed decisions on insurance applications.Analytical Skills

Ability to analyse complex insurance applications, identifying potential risks and coverage needs.Attention to Detail

Meticulousness in reviewing insurance applications and policy documents to ensure accuracy and compliance.Business Negotiation Skills

Proficiency in negotiating terms and conditions of insurance policies with clients and brokers.Decision Making

Capable of making informed decisions based on risk assessment and policy guidelines.Related Job Roles

Explore Other Programmes

Browse AllYou have bookmarked your first item!

Find it in My Discoveries with insights on your interests!