Personal / Consumer Bankers provide financial advice to customers in the bank. They are the most important staff to contact for personal finances.

Personal/Consumer Banker Job Description

- Understand the client's needs and provide sound financial advice that fits their needs and objectives.

- Ensure advice to clients meets the bank's prescribed standards and industry regulatory requirements.

- Source and contact individual prospects to build a robust client base.

- Ensure high-quality and seamless customer service built on trust and personalised service.

- Update customers' portfolios regularly to ensure alignment with their evolving financial goals and market conditions.

Note

Success as Personal Bankers hinge on community reputation, networking skills and affability beyond just knowing banking rules. Education matters less than connections.

What you should know about Personal / Consumer Banker jobs in Singapore

Nature of Work

You can work in dynamic banks like Citibank & HSBC, providing personalised services and financial advice to meet client needs in Singapore.Key Advice

You need to be patient when assisting customers and explaining terminologies and procedures, especially when the terms are technical.-

Entry RequirementsEntry Requirements

- Minimally a GCE 'A' Level certificate. A diploma or degree in a finance-related field is preferred.

- Most local banks offer formal training programmes. To become a Certified Personal Banker, you must pass industry exams known as CMFAS (Capital Markets Financial Advisory Services).

-

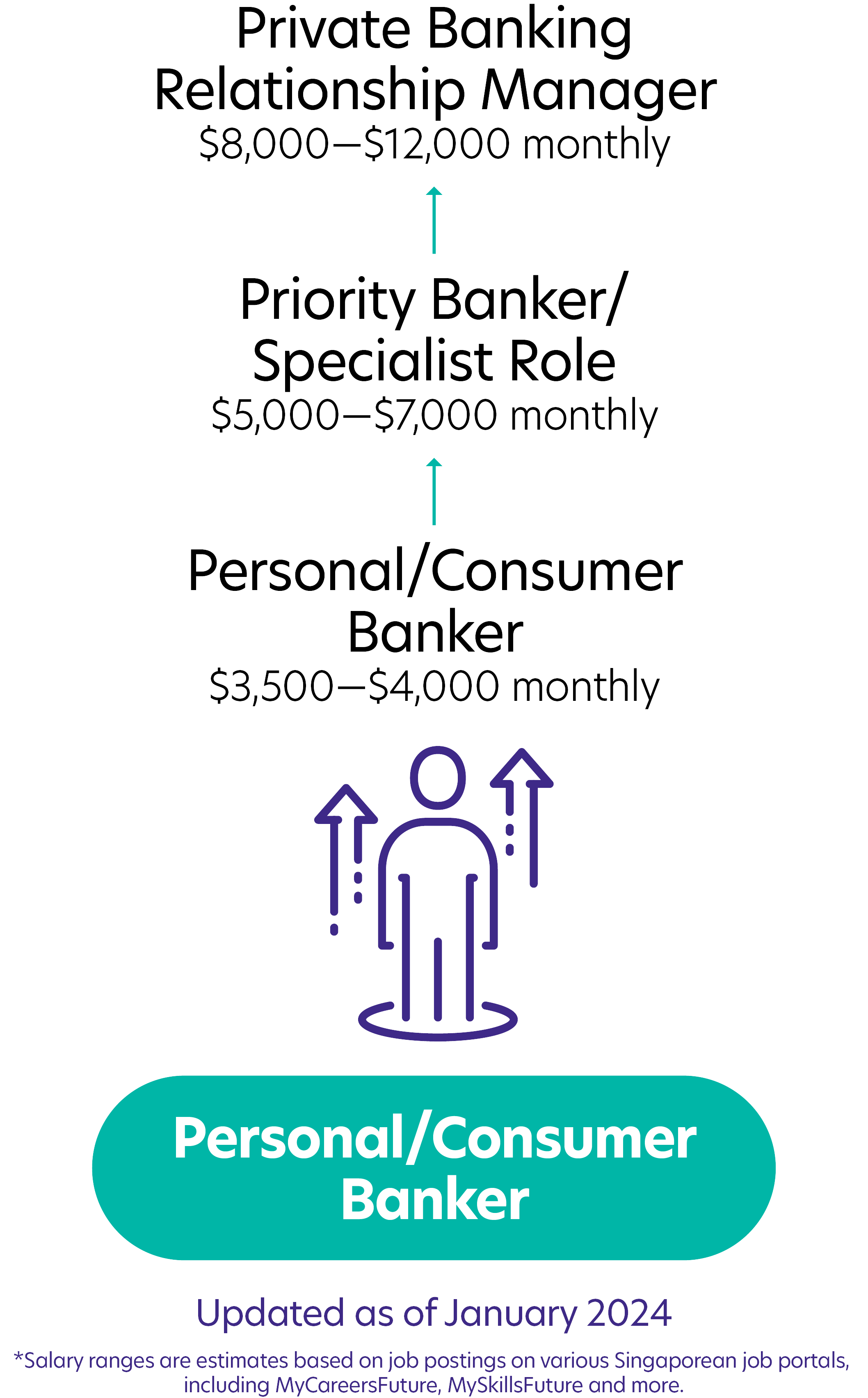

Possible PathwayPossible Pathway

Skills you need to pursue a Personal / Consumer Banker career in Singapore

Hard Skills

Hard Skills

Understanding Different Lifestyle Management of Individuals

Understand client needs to offer tailored solutions and advice.Able to Manage Confidential Information

Manage client information with integrity to ensure trust and compliance.Data Analytics

Analyse financial data and trends using analytics for decisions and client adviceCustomer Orientation

Prioritise customer service, understand client needs, and provide personalised banking experiences.Adaptability

Adapt to market changes, client needs, and regulations to offer relevant financial solutions.Problem-Solving

Problem-solving skills are key to resolving client issues and aligning solutions with their financial goals.Related Job Roles

Explore Other Programmes

Browse AllYou have bookmarked your first item!

Find it in My Discoveries with insights on your interests!