Actuarial Executives analyse the financial costs of risk and uncertainties to carry out technical pricing for financial products.

Actuarial Executive Job Description

- Analyse and utilise statistical data to extract meaningful insights to derive the rates for financial products.

- Assess portfolio risks using mathematical modelling techniques and statistical concepts.

- Calculate the pricing of insurance benefits and credit schemes ensuring that products are priced fairly and competitively, while also guaranteeing the long-term profitability of the company.

- Monitor the development of clients' accounts with proper documentation.

- Participate in technical knowledge-sharing activities and events.

Note

Actuarial Executives in Singapore are the number-crunching wizards who help companies navigate financial risks, all while enjoying the city's vibrant culture.

What you should know about Actuarial Executive jobs in Singapore

Nature of Work

Typically, Actuarial Executive jobs include the application of Economics, Applied Statistics, Finance, Accounting, Calculus, and Computer Science.Key Advice

Learn how to navigate and use Accounting software early. They are extremely helpful in checking compliance standards and assessing risks!-

Entry RequirementsEntry Requirements

- A bachelor's degree in Actuarial Science or related studies such as Mathematics is required.

- Knowing Economics, Accounting, Computer Science, Statistics, Calculus, or Probability will be good. The theory and practice behind these topics will be a huge advantage for you!

-

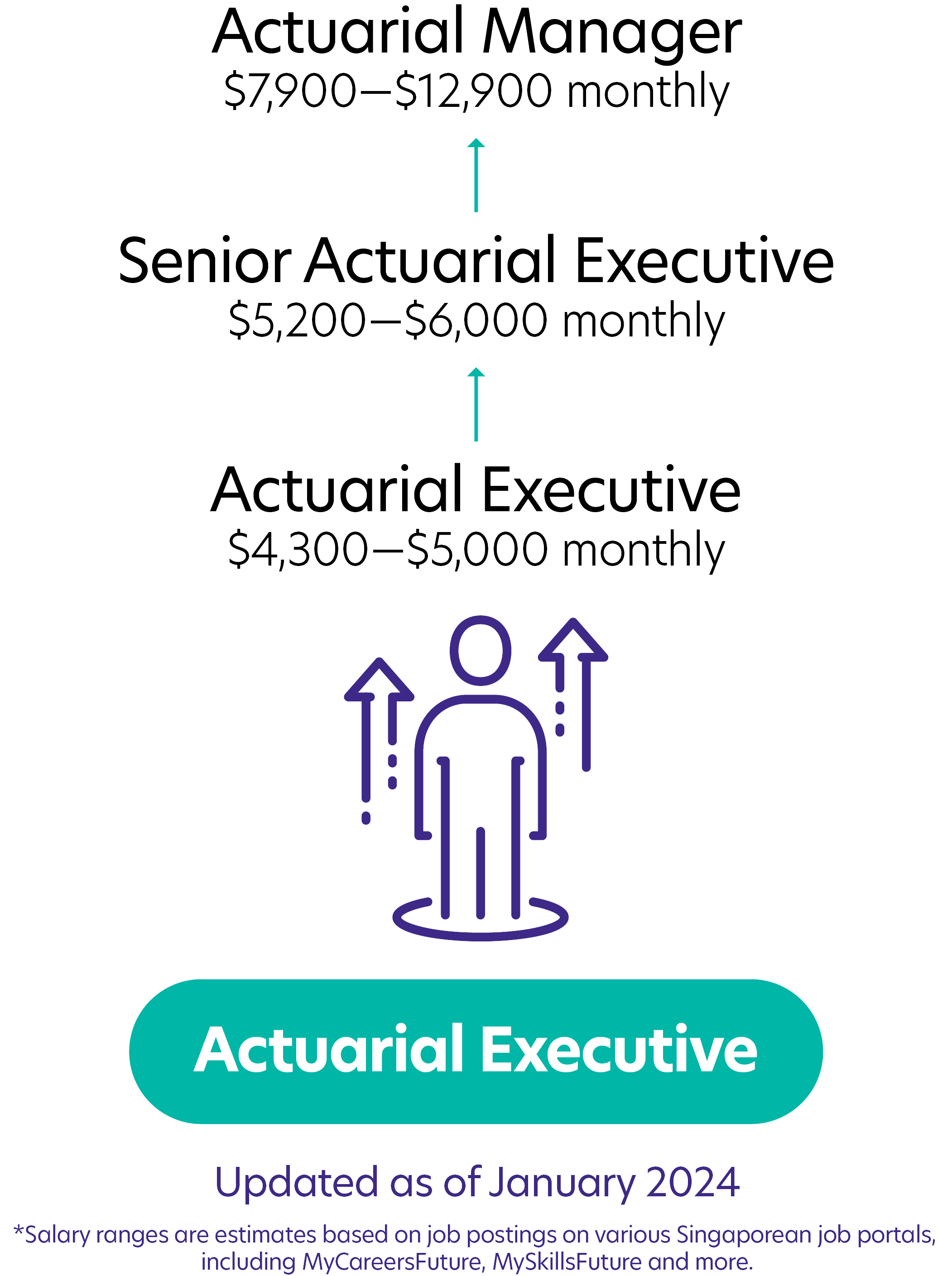

Possible PathwayPossible Pathway

Skills you need to pursue an Actuarial Executive career in Singapore

Financial Modelling

Skills in creating financial models like LBO and DCF for risk assessment and decision-making.Data Analytics

Ability to analyse large sets of data for predicting trends and calculating risks.Programming and Coding

Knowledge of programming languages like Python or R for automating tasks and data analysis.Communication

Clear and effective sharing of complex information with others.Innovative Problem-Solving

Creative approach to solving challenges in actuarial tasks.Critical Thinking

Can analyse information carefully and make logical decisions.Related Job Roles

Explore Other Programmes

Browse AllYou have bookmarked your first item!

Find it in My Discoveries with insights on your interests!