ONLINE

Financial Emotional Resilience™: A Toolkit for Aspiring Mentors 📚

About this programme

Financial Emotional Resilience™: A Toolkit for Aspiring Mentors 📚

Open to all interested in mentoring!

How often do you see mentees struggling to understand financial concepts and put them into practice? 🤔

How often do you see mentees juggling work, studies, and long-term goals while feeling pressured to make the "right" financial decisions? 😭

How often do you see mentees challenged by financial stress that money dictates how they live their lives? 🌱

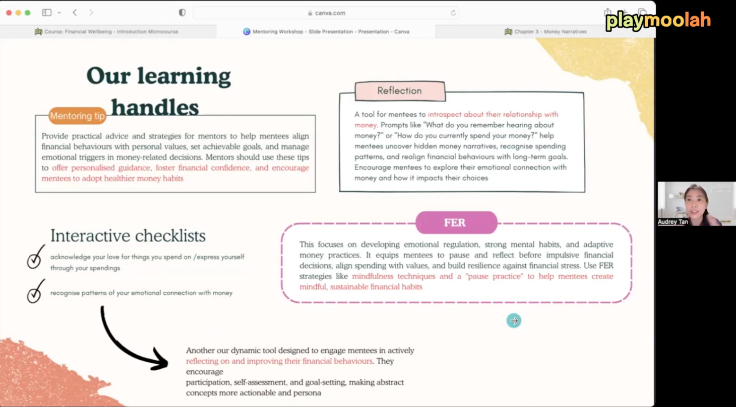

PlayMoolah’s Financial Emotional Resilience™ Workshop helps adults learn about the mental and emotional side of money management, tackling the above challenges. Here you'll go beyond basic financial planning—cover practical skills of budgeting, saving, and investing while building positive habits for financial resilience.

What You'll Learn:

Practical knowledge and technique to guide your mentees with:

- Emotional Regulation: Understand how mindset impacts financial decisions.

- Daily Money Practices: Gain essential budgeting, saving, and investing skills.

- Mental Habits: Develop habits that lead to long-term success.

Ready to get started?

📝 Sign up for our complimentary introductory workshop now!

Unlock Financial Confidence Today!

Images may be captured during the event using film photography, digital photography, video or other medium and may be used on the website.

Explore Other Programmes

Browse AllYou have bookmarked your first item!

Find it in My Discoveries with insights on your interests!