Wealth and Estate Planners provide financial advice to clients on how to best manage their wealth and assets.

Wealth and Estate Planner Job Description

- Analyse changes in client or market situations that may affect clients' wealth planning.

- Study and revise clients' financial needs and goals for the short, medium and long run.

- Recommend and advise financial products or strategies that best suit the client's needs.

- Work closely with specialists in respective fields as and when required (e.g. will writing, tax filing etc.).

- Monitor market trends and draft consolidated forecasts and budgets.

Note

The nature of the job requires you to mingle and interact with people - you are rarely desk-bound.

What you should know about Wealth and Estate Planner jobs in Singapore

Nature of Work

Wealth and Estate Planners manage not just housing but assets like investments, income, and insurance plans, too!Key Advice

Being clear and concise about a client's finances is critical to becoming great Wealth & Estate Planners.-

Entry RequirementsEntry Requirements

- A diploma or bachelor's degree in Banking and Financial Investment, or Banking, Insurance, and Financial Services N.E.C. (including Computational Finance) is preferred.

- Having an understanding of Property Law is useful in the field.

- Possess analytical skills and have the ability to identify market trends and insights.

-

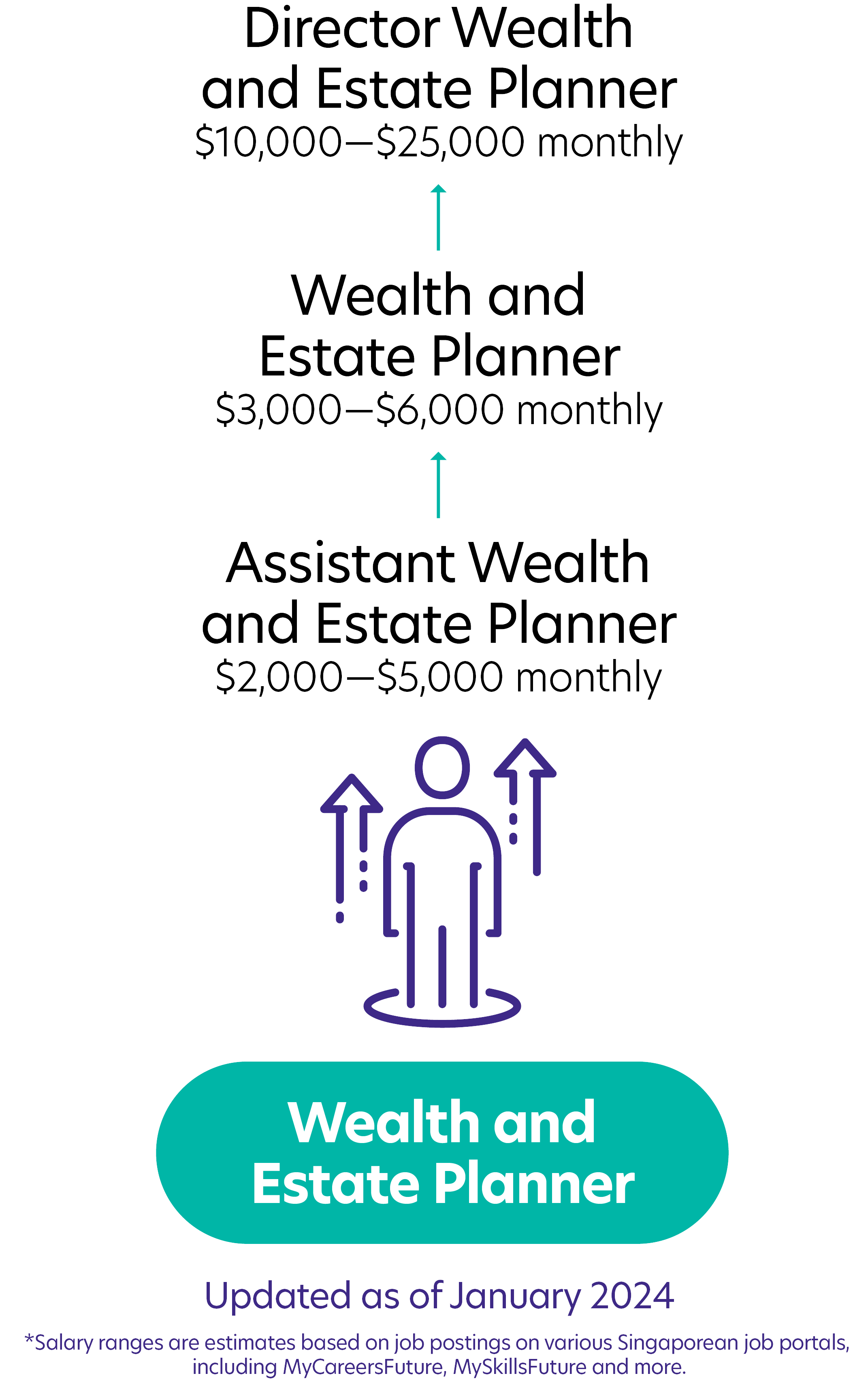

Possible PathwayPossible Pathway

Skills you need to pursue a Wealth and Estate Planner career in Singapore

Hard Skills

Hard Skills

Financial Planning Tools

Proficient in Financial Markets, Accounting, Risk Management and Investment products for comprehensive planning.Advisory Skills

Ability to provide financial advice based on an individual’s financial situation, goals, and risk tolerance.Data Analysis

Proficiency in analysing financial data to make informed decisions and provide accurate recommendations.Customer Orientation

Understands and meets the needs of clients, ensuring their satisfaction and loyalty.Global Perspective

Awareness of global financial markets and understanding how they impact wealth management.Influencing and Negotiation Skills

Ability to negotiate effectively with clients, ensuring mutually beneficial outcomes.Related Job Roles

Explore Other Programmes

Browse AllYou have bookmarked your first item!

Find it in My Discoveries with insights on your interests!